Relative Strength Index - RSI

What is the Relative Strength Index - RSI

The relative strength index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can have a reading from 0 to 100. The indicator was originally developed by J. Welles Wilder and introduced in his seminal 1978 book, "New Concepts in Technical Trading Systems."

Calculating the Relative Strength Index - RSI

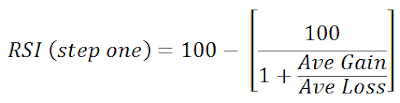

The relative strength index (RSI) is a two-part calculation that starts with the following formula:

The average gain or loss used in the calculation is the average percentage gain or losses during a lookback period. The formula uses positive values for the average losses.

The standard is to use 14 periods to calculate the initial RSI value. For example, imagine the market closed higher seven out of the past 14 days with an average gain of 1%. The remaining seven days all closed lower with an average loss of -0.8%. The calculation for the first part of the RSI would look like the following expanded calculation:

Once there are 14 periods of data available, the second part of the RSI formula can be calculated. The second step of the calculation smooths the results.

The RSI will rise as the number and size of positive closes increase, and it will fall as the number and size of losses increase. The second part of the calculation smooths the result, so the RSI will only near 100 or 0 in a strongly trending market.

Traditional interpretation and usage of the RSI is that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price. An RSI reading of 30 or below indicates an oversold or undervalued condition.

As you can see in the previous chart, the RSI indicator can remain in "overbought" territory for extended periods while a stock is in an uptrend. The indicator can stay in "oversold" territory for a long time while a stock is in a downtrend. This can be confusing for new analysts, but learning to use the indicator within the context of the prevailing trend will clarify these issues.

Tips for Understanding Overbought or Oversold Readings on the RSI

The primary trend of the stock or asset is an important tool in making sure the indicator's readings are properly understood. For example, well-known market technician Constance Brown, CMT, has promoted the idea that an oversold reading on the RSI in an uptrend is likely much higher than 30%, and an overbought reading on the RSI during a downtrend is much lower than the 70% level.

As you can see in the following chart, during a downtrend, the RSI would peak near the 50% level rather than 70%, which could be used by investors to more reliably signal bearish conditions. Many investors will apply a horizontal trendline that is between 30% or 70% levels when a strong trend is in place to better identify extremes. Modifying overbought or oversold levels when the price of a stock or asset is in a long-term, horizontal channel is usually unnecessary.

A related concept to using overbought or oversold levels appropriate to the trend is to focus on trading signals and techniques that conform to the trend. In other words, using bullish signals when the price is in a bullish trend and bearish signals when a stock is in a bearish trend will help to avoid the many false alarms the RSI can generate.

Techniques for Using the RSI Indicator

Divergences

A bullish divergence occurs when the RSI creates an oversold reading followed by a higher low that matches correspondingly lower lows in the price. This indicates rising bullish momentum, and a break above oversold territory could be used to trigger a new long position.

A bearish divergence occurs when the RSI creates an overbought reading followed by a lower high that matches corresponding higher highs on the price.

As you can see in the following chart, a bullish divergence was identified when the RSI formed higher lows as the price formed lower lows. This was a valid signal, but divergences can be rare when a stock is in a stable long-term trend. Using flexible oversold or overbought readings will help identify more valid signals than would otherwise be apparent.

Swing Rejections

Another trading technique examines the RSI's behavior when it is re-emerging from overbought or oversold territory. This signal is called a bullish "swing rejection" and has four parts:

- RSI falls into oversold territory.

- RSI crosses back above 30%.

- RSI forms another dip without crossing back into oversold territory.

- RSI then breaks its most recent high.

As you can see in the following chart, the RSI indicator was oversold, broke up through 30% and formed the rejection low that triggered the signal when it bounced higher. Using the RSI in this way is very similar to drawing trendlines on a price chart.

Like divergences, there is a bearish version of the swing rejection signal that looks like a mirror image of the bullish version. A bearish swing rejection also has four parts

- RSI rises into overbought territory.

- RSI crosses back below 70%.

- RSI forms another high without crossing back into overbought territory.

- RSI then breaks its most recent low.

The following chart illustrates the bearish swing rejection signal. As with most trading techniques, this signal will be most reliable when it conforms to the prevailing long-term trend. Bearish signals in negative trends are less likely to generate a false alarm.

Relative Strength Index (RSI) Summary

The RSI compares bullish and bearish price momentum and displays the results in an oscillator that can be placed alongside a price chart. The indicator can fluctuate between 100% and 0% and is considered overbought when the indicator is above 70% and oversold when the indicator is below 30%. Like most technical indicators, its signals are most reliable when they conform to the long-term trend. True reversal signals are rare and can be difficult to separate from false alarms.

Comments

Post a Comment