MARUBOZU CANDLESTICK

MARUBOZU CANDLE

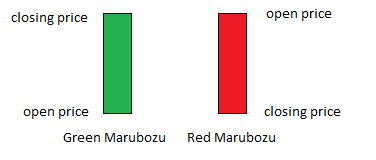

The Marubozu candlestick

pattern is a one-candle, easy-to-spot signal with a very clear meaning. It

comes in both a bearish (red or black) and a bullish (green or white) form, and

it commands attention with its long and sturdy shape. To learn more about how Marubozu

candlesticks form, why they form, and what they can tell you about the current

state of the market.

Formation

It

doesn’t get any simpler than this! Even the Doji,

that tiny little sprite, isn’t easier to spot than the Marubozu.

If you think you’ve found a Marubozu

candlestick pattern, look for the following criteria:

First, the

single candle involved in the signal should have a long real body. Second, there

must not be an upper or a lower wick (a.k.a., a shadow).

That’s

all there is to it! You’re looking for a big block

without any extraneous limbs or extensions.

The

signal can be white/green or black/red, and it can appear anywhere on the

chart. A white/green Marubozu

moves upward and is very bullish, and a black/red Marubozu

moves downward and is very bearish. The longer the candle is, the more dramatic

the jump in price has been (whether it jumped up or down).

Sometimes

you will see these signals called simply White Marubozu

and Black Marubozu.

Meaning

The

word marubozu means

“bald head” or “shaved head” in Japanese, and this is reflected in the

candlestick’s lack of wicks. When you see a Marubozu

candlestick, the fact that there are no wicks tells you that the session

opened at the high price of the day and closed at the low price of the

day. In a bullish Marubozu, the

buyers maintained control of the price throughout the day, from the opening

bell to the close. In a bearish Marubozu,

the sellers controlled the price from the opening bell to the close.

Depending

on where a Marubozu is

located and what color it is, you can make predictions:

If a

White Marubozu

occurs at the end of an uptrend, a continuation is likely.

If a

White Marubozu

occurs at the end of a downtrend, a reversal is likely.

If a

Black Marubozu

occurs at the end of a downtrend, a continuation is likely.

If a

Black Marubozu

occurs at the end of an uptrend, a reversal is likely.

However,

because these conjectures fail to provide 100% certainty, it is always

best to confirm your suspicions by watching the candles that appear after the Marubozu.

If the next few candles confirm your forecast (or if you spot another

supportive candlestick pattern), feel free to move forward with confidence.

Comments

Post a Comment