Relative Strength Index - RSI

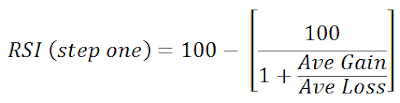

What is the Relative Strength Index - RSI The relative strength index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can have a reading from 0 to 100. The indicator was originally developed by J. Welles Wilder and introduced in his seminal 1978 book, "New Concepts in Technical Trading Systems." Calculating the Relative Strength Index - RSI The relative strength index (RSI) is a two-part calculation that starts with the following formula: The average gain or loss used in the calculation is the average percentage gain or losses during a lookback period. The formula uses positive values for the average losses. The standard is to use 14 periods to calculate the initial RSI value. For example, imagine the market closed higher seven out of the p...